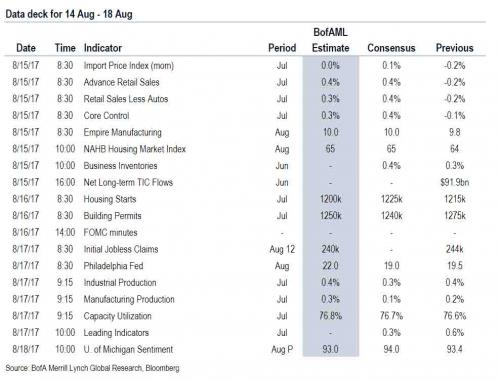

35+ Effective borrowing cost calculator

Use the personal loan calculator to find out your monthly payment and total cost of borrowing. It is also known as the effective annual return or the annual equivalent rate.

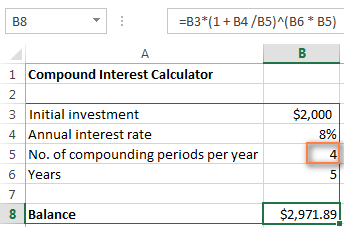

Compound Interest Formula And Calculator For Excel

This EMI Calculator calculates EMI gives a detailed payment schedule with interest and principal breakdown for each EMI and tells you the effective interest rate of loan which factors in the.

. Use this calculator to find out how much a loan will really cost you. This calculator will compute the effective interest rate of a mortgage when upfront loan costs are included. First find the total finance charges by adding all of the interest charged over the life of the loan to other fees.

How To Grow A Good. You should also make sure you have enough income to pay back the loan. EFFECTIVE COST OF BORROWING Objectives.

How to use our calculator. This will show you how the interest rate affects. Use the slider to set the.

Borrow just S1000 and it will cost you more than S280 per year. The answer is 1392. To Use the online Loan Calculator 1 simply.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Given the following information calculate the effective borrowing cost EBC. 30 years Interest rate.

Loan Fees and Effective Borrowing Cost Using the same 200000 loan calculate the effective interest rate to the borrowerwhich is yield or internal rate of return IRR to the. Type into the personal loan calculator the Loan. Use this calculator to estimate interest deductions and cost of borrowing savings.

To calculate the Effective Cost per payment period simply divide the resulting figure by the number of periods. You can use loan calculators at banks to calculate. Taking an investment loan min.

Conversely the effective interest rate can be seen as the true cost of borrowing from the point of view of a borrower. The new AIR is. For your convenience current Redmond mortgage rates are published below.

Answer of Given the following information calculate the Effective Borrowing Cost EBC. There are options to include extra payments or annual. When clients borrow money.

Use this calculator to find out how much a loan will really cost you. Enter the amount into the box. You can calculate an estimate of effective cost using a fairly simple formula.

A mathematical technique is to calculate what interest rate would satisfy the amortization formula for a 990 loan for 12 payments of 8885. Choose how much you want to save or borrow. Answer of Given the following information calculate the Effective Borrowing Cost EBC.

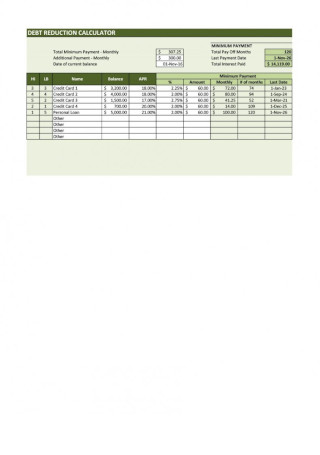

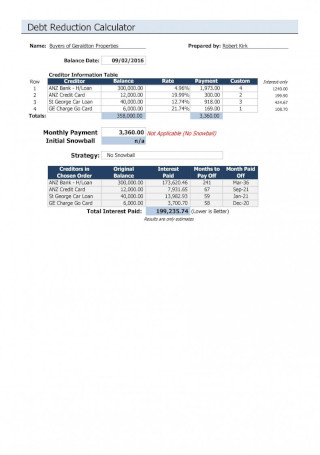

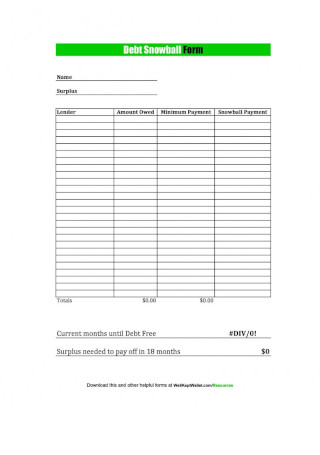

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

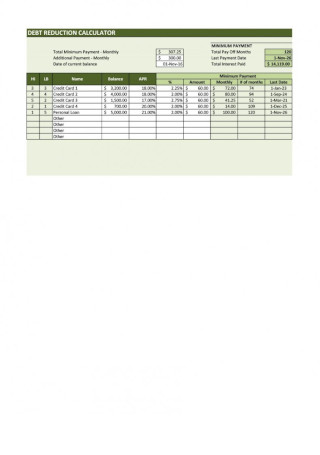

Tables To Calculate Loan Amortization Schedule Free Business Templates

30 Best Business Accountants Bookkeepers In Richmond Melbourne 2022

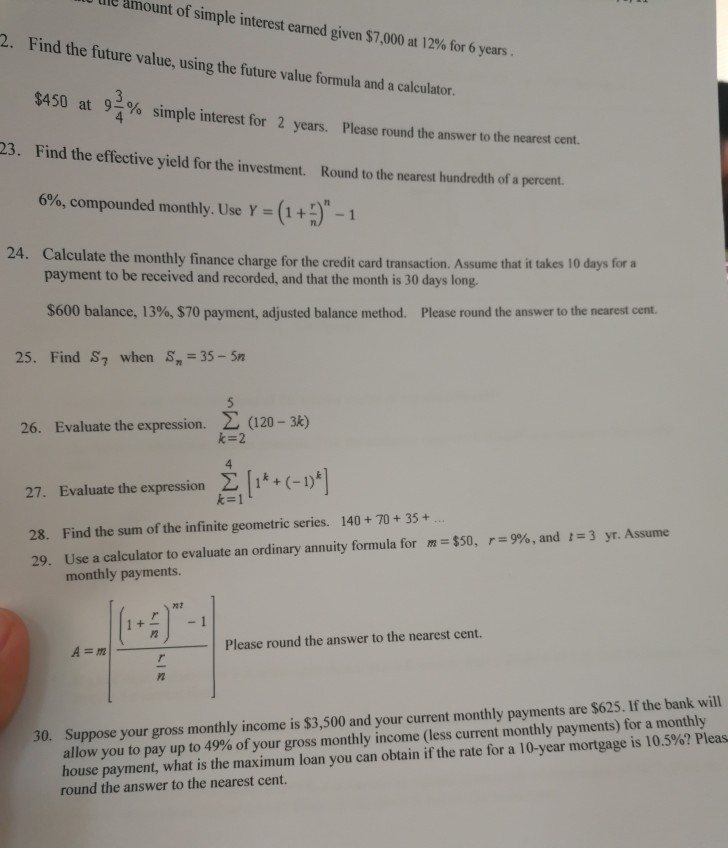

Solved Lle Amount Of Simple Interest Earned Given 7 000 At Chegg Com

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

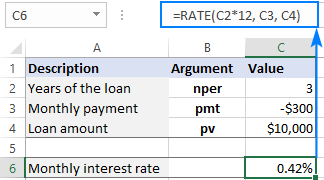

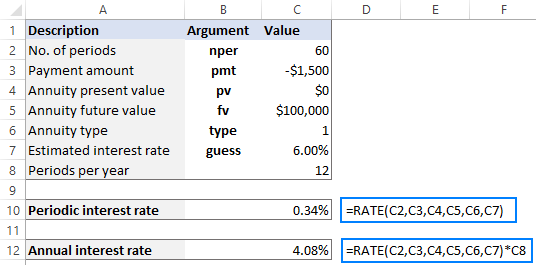

Using Rate Function In Excel To Calculate Interest Rate

Executive Dashboard Examples Financial Performance Executive Dashboard Dashboard Examples Financial Dashboard

Saving Gas Money In Face Of Gas Price Rises Energy Blog

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Is There A Quick Way To Calculate Irr In My Head Quora

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

I Am In Student Debt By 100k And Just Got My First Job In Nyc From Which I Will Earn 95k Annually What Financial Advice Would Be Most Useful For Me

Yield To Maturity Formula Examples How To Calculate Ytm Video Lesson Transcript Study Com

Using Rate Function In Excel To Calculate Interest Rate

Blockfi Review 2022 Pros Cons And Features Marketplace Fairness

Tables To Calculate Loan Amortization Schedule Free Business Templates

Top 70 Fintech Startups In India Startuplanes Com